Chile’s Entel is fighting back for control of the country’s wireless market — and it’s far from clear that they’ll emerge as the winner.

In January and February, for the first time in over four years, Empresa Nacional de Telecomunicaciones SA, or Entel, added mobile customers in Chile from its rivals after bleeding an average of more than 90,000 lines per month in 2017.

It’s a sign that Entel’s moves to fend off newer players from eating into their share of the Chilean market, such as unlimited data promotions, are taking hold, even if investor sentiment has a ways to go. While analysts are the most optimistic they’ve been on the stock since August 2016, with seven buy-equivalent recommendations, Entel shares remain among the worst performers of the past year, falling 12 percent even as the IPSA gained 15 percent amid optimism over economic growth and investment.

The main opponent in the market share battle has been WOM. Owned by London-based Novator Partners LLP, the wireless carrier started operations in 2015, attracting attention with racy ads depicting topless women in bars, among others, and stealing market share from incumbents with ultra-low prices. Entel countered with promotions targeted at WOM customers specifically.

WOM’s not taking it lying down: The company has taken Entel to court, arguing that it isn’t playing fair by offering cheap contracts only to people who leave the provider. Lawyers for Entel responded in court documents seen by local press by saying WOM is playing the victim after years of using «oversexualized» advertising campaigns and vilifying rivals.

«February was a good wake-up call for us, and we’ll keep working to keep growing,» Chris Bannister, CEO of WOM, said in an emailed response to questions. «No doubt, our intention is to recover the leadership in portability» while at the same time improve service quality.

Entel declined to comment on the legal battle with WOM for this story.

The Fight

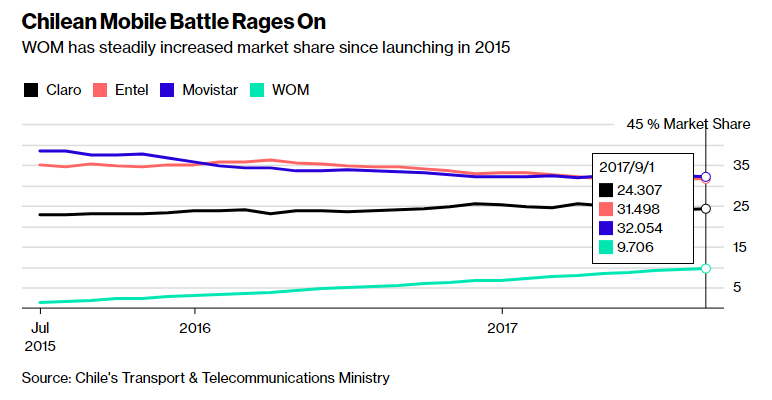

WOM expanded its market share from 1.3 percent in 2015, when it launched the brand after buying Nextel’s local operation, to 9.7 percent by September, according to data from the Telecommunications Ministry. Meanwhile, Entel and Telefonica SA unit Movistar have seen market share fall to 31 percent from 35 percent and 32 percent from 38 percent, respectively. Claro, a subsidiary of America Movil, has been able to increase market share by a single percentage point to 24 percent.

The incumbents are trying to strike back, becoming more nimble with plans and perks to entice wayward Chilean consumers, according to Carlos Huaman, executive director of Lima-based telecommunications consultancy DN Consultores.

«The bigger companies have learned to become more agile,» Huaman said. «If before a special promotion would last three to five months, now they’re coming out with new promotions on average every month.»

In August, Entel started offering plans with unlimited data, Manuel Araya, Entel’s head of regulation and corporate affairs said in February.

And it looks like the focus on data and unlimited plans could be working, Banco Santander SA analysts Pedro Pereira and Nicolas Schild said in a March 19 report, reiterating a buy recommendation for the stock. Goldman Sachs Group Inc. initiated coverage of the stock on April 2 with a buy.

Falling revenue

Not all analysts are convinced that better times are ahead. JPMorgan’s Andre Baggio is standing firm with his underweight recommendation, noting that Entel’s mobile revenue has been falling for the past two years.

«I want to see more evidence that the bleeding of customers in Chile has stopped,» Baggio said in a phone interview.

Meanwhile, WOM is aiming for further growth. It plans to invest $350 million by 2019 and seize 25 percent of the local market, according to a report in Pulso, citing head of marketing Sebastian Precht.

«From the beginning people have been writing WOM off, saying that it wouldn’t be an issue,» Baggio said. «But it is.»

Artículo original publicado por Bloomberg